Getmyoffer Capitalone Com – A Comprehensive Guide!

In the realm of credit cards, finding the right offer tailored to your financial needs and lifestyle can be a daunting task.

Getmyoffer Capital One is an online platform where individuals can access personalized credit card offers from Capital One based on their financial profiles and creditworthiness.

In this article, we delve into what Getmyoffer Capital One is, how it works, what its benefits are, and how you can make the most of this platform to secure the credit card that suits you best.

What Is Getmyoffer Capital One?

Getmyoffer Capital One is a user-friendly website where individuals can explore pre-approved credit card offers from Capital One. These offers are tailored to match the user’s financial history and creditworthiness, presenting them with options most likely to be approved.

How To Access Getmyoffer Capital One?

1. Visit The Website:

Start by opening your web browser and navigating the official Getmyoffer Capital One website. You can do this by typing “Getmyoffer Capital One” into the search bar and selecting the official website from the search results.

2. Locate Your Offer Letter Or Email:

If you’ve received an offer letter or email from Capital One containing a reservation number and access code, keep it handy. You’ll need these details to access your personalized credit card offers.

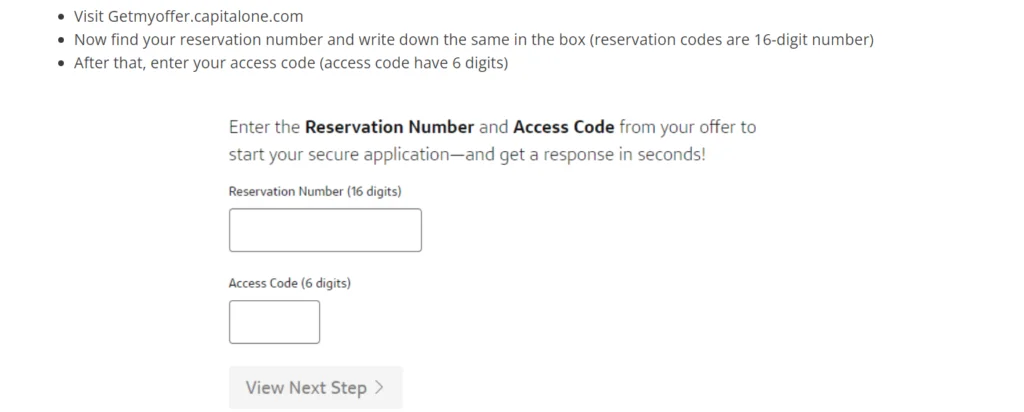

3. Enter the Reservation Number And Access Code:

On the Getmyoffer Capital One website’s homepage, you’ll find fields where you can enter your reservation number and access code. These are typically provided in the offer letter or email. Input the numbers carefully to ensure accuracy.

4. Click “Get Started” Or “Continue”:

Once you’ve entered the required information, click the appropriate button to proceed. This will direct you to a page where you can view the credit card offers that are pre-approved for you based on your financial profile.

5. Explore Your Offers:

Take your time to review the credit card offers presented to you. Each offer will detail the card’s features, benefits, and any applicable terms and conditions. Consider rewards, APR rates, and annual fees to determine which offer best fits your needs and preferences.

Benefits Of Getmyoffer Capital One:

- Convenience:

Getmyoffer Capital One offers a convenient online platform where users can access personalized credit card offers from Capital One. This eliminates the need to visit a bank or speak to a representative in person, saving time and effort in the application process.

- Personalized Offers:

The platform provides users with pre-approved credit card offers tailored to their financial profiles and creditworthiness. This means you’ll only see offers you’re likely to qualify for, increasing the chances of approval.

- Instant Access:

Upon entering the required reservation number and access code, users can access their personalized credit card offers instantly. This allows for quick decision-making and application submission.

- Streamlined Application Process:

Getmyoffer Capital One simplifies the credit card application process, guiding users through each step with clear instructions. The online application can be completed quickly and easily from the comfort of your own home.

- Transparent Information:

Each credit card offer presented on Getmyoffer Capital One includes detailed information about the card’s features, benefits, and applicable terms and conditions. This transparency enables users to decide which offer best suits their needs.

- Opportunity For Special Offers:

Users may sometimes receive special promotions or incentives through Getmyoffer Capital One, such as bonus rewards or introductory APR rates. These exclusive offers can provide added value to cardholders.

Eligibility Criteria:

While Getmyoffer Capital One streamlines the credit card application process, it’s essential to meet the eligibility criteria set by Capital One. Credit score, income level, and existing financial obligations may influence eligibility for specific offers.

Understanding The Application Process:

- Visit The Website:

Begin by visiting the official Getmyoffer Capital One website using your web browser. You can do this by typing the website’s URL into the address bar and pressing Enter.

- Enter Required Information:

On the website’s homepage, you’ll be prompted to enter certain information to access your personalized credit card offers. This typically includes your reservation number and access code, which can be found on the offer letter or email you received from Capital One.

- Access Your Offers:

Once you’ve entered the required information, click the “Get Started” or “Continue” button to proceed. This will grant you access to a list of credit card offers that are pre-approved for you based on your financial profile and creditworthiness.

- Review Offer Details:

Take the time to carefully review each credit card offer presented to you. Pay attention to details such as the card’s features, benefits, APR rates, annual fees, and any introductory promotions or rewards.

- Select Your Preferred Offer:

After reviewing your options, select the credit card offer that best aligns with your financial goals and preferences. Click on the offer to proceed to the next step.

- Complete The Online Application:

Follow the prompts to complete the online application for the selected credit card offer. You’ll need to provide personal information such as your name, address, Social Security number, employment status, and income.

Tips For Maximizing Your Chances Of Approval:

1. Check Your Credit Score:

Before applying for a credit card, knowing where you stand in terms of creditworthiness is essential.

Check your credit score and review your credit report to identify any errors or discrepancies that must be addressed.

2. Understand The Requirements:

Take the time to understand the eligibility criteria for the credit card offers available through Getmyoffer Capital One. This includes minimum credit score, income requirements, and other financial obligations.

3. Improve Your Credit Profile:

If your credit score could be better, consider taking steps to improve it before applying for a credit card.

This may involve paying down existing debt, making on-time payments, and addressing negative items on your credit report.

4. Review Your Finances:

Assess your current financial situation to ensure that you can afford to take on additional credit. Consider your income, expenses, and debt obligations when determining whether to apply for a new credit card.

5. Choose Wisely:

Select the credit card offer that aligns best with your financial goals and lifestyle. Consider rewards, APR rates, annual fees, and introductory promotions or bonuses.

6. Apply For One Card At A Time:

While it may be tempting to apply for multiple credit cards simultaneously, doing so can negatively impact your credit score and decrease your chances of approval. Focus on applying for one card at a time and wait for a decision before considering other offers.

Conclusion:

In conclusion, Getmyoffer Capital One is a valuable resource for individuals seeking to explore and apply for Capital One credit cards. Its user-friendly interface, personalized offers, and convenient application process simplifies the journey of finding the right credit card for your financial needs.

FAQs:

1. Is Getmyoffer Capital One Safe To Use?

Yes, Getmyoffer Capital One is a secure platform provided by Capital One to facilitate credit card offers for potential applicants.

2. Can I Apply For Multiple Credit Card Offers Through Getmyoffer Capital One?

While you can explore multiple offers, applying for the one that best suits your needs is advisable to avoid impacting your credit score.

3. How Long Does It Take To Receive A Decision On My Credit Card Application?

Decision times can vary but are often provided within a few minutes to a few business days.

4. What Should I Do If I Receive No Pre-Approved Offers?

If you don’t receive pre-approved offers, you can explore other Capital One credit card options directly through their website.

5. Are There Any Fees Associated With Using Getmyoffer Capital One?

Accessing Getmyoffer Capital One is free of charge, and there are no fees associated with exploring credit card offers through the platform.

Read More: