Green Dollar Loans – A Complete Guide!

In today’s rapidly changing world, where environmental sustainability is increasingly becoming a priority, the concept of Green Dollar Loans has emerged as a significant financial tool.

Green Dollar Loans finance eco-friendly projects, aiding individuals and businesses in sustainability efforts while meeting financial needs.

In this article, we’ll explore the various aspects of Green Dollar Loans, including their benefits, types, application process, and challenges, shedding light on how they can help individuals and organizations positively impact the environment while addressing their financial needs.

Introduction To Green Dollar Loans:

Green Dollar Loans, eco-friendly loans, or green financing are specialized financial instruments designed to support projects and initiatives that promote environmental sustainability and reduce carbon emissions.

These loans provide individuals, businesses, and government entities with the necessary funds to invest in environmentally friendly projects, such as renewable energy installations, energy-efficient upgrades, sustainable agriculture practices, and eco-friendly business initiatives.

Benefits Of Green Dollar Loans:

1. Environmental Impact:

Green Dollar Loans contribute to positive environmental outcomes by funding projects that promote sustainability and reduce carbon emissions. These projects can include investments in renewable energy, energy-efficient technologies, and eco-friendly infrastructure, leading to a cleaner and healthier planet.

2. Financial Accessibility:

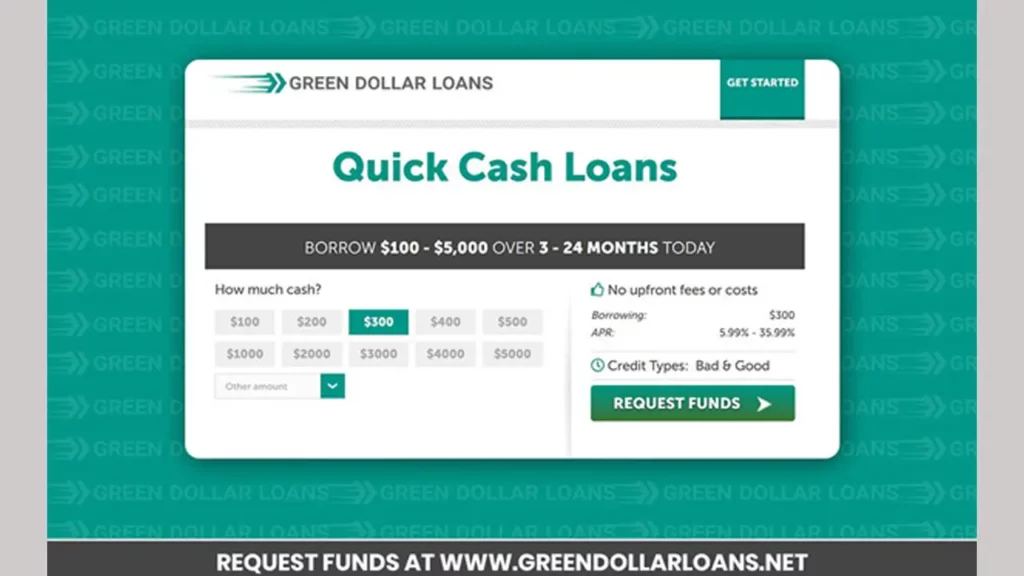

Green Dollar Loans offer accessible financing options to individuals and businesses interested in implementing environmentally friendly initiatives. With competitive interest rates and flexible repayment terms, these loans enable many borrowers to invest in green projects without facing significant financial barriers.

3. Cost Savings:

By investing in energy-efficient upgrades or renewable energy systems, borrowers can benefit from long-term cost savings on utility bills. Green Dollar Loans help finance these investments upfront, allowing borrowers to recoup their expenses over time through reduced energy costs and increased operational efficiency.

4. Market Competitiveness:

Embracing sustainability can enhance the competitiveness of businesses in today’s market. Green Dollar Loans enable companies to differentiate themselves by demonstrating their commitment to environmental responsibility, attracting environmentally conscious consumers, investors, and partners.

Types Of Green Dollar Loans:

1. Personal Green Loans:

These loans are tailored for individuals looking to finance eco-friendly home improvements, such as solar panel installations or energy-efficient appliances.

2. Business Green Loans:

Designed for companies investing in green technologies, sustainable production methods, or environmentally responsible supply chains.

3. Government Green Loans:

Offered by public institutions and agencies to support large-scale environmental projects like renewable energy infrastructure or conservation initiatives.

How To Obtain Green Dollar Loans:

1. Eligibility Criteria:

Determine if you meet the criteria, which often includes demonstrating a commitment to environmental sustainability and the feasibility of your proposed project.

2. Application Process:

Submit a detailed project proposal and financial and environmental impact assessments to the lender for review.

3. Approval And Disbursement:

Upon approval, funds are disbursed to finance the proposed project, and you’re responsible for implementing it according to the agreed-upon terms and conditions.

Factors To Consider Before Applying:

1. Interest Rates:

Evaluate the interest rates different lenders offer to ensure you get the best deal for your financial situation.

2. Repayment Terms:

Understand the repayment schedule and terms associated with the loan to avoid financial strain or default.

3. Impact On Credit Score:

Consider how taking out a Green Dollar Loan may affect your credit score and overall financial health before applying.

4. Loan Purpose:

Clarify the specific purpose of the loan and ensure it aligns with your environmental and financial goals.

5. Collateral Requirements:

Check if the loan requires any collateral and assess whether you’re comfortable with the risk involved.

6. Fees And Charges:

Be aware of any additional fees or charges associated with the loan, such as origination fees or prepayment penalties.

Challenges And Risks Associated With Green Dollar Loans:

1. Market Volatility:

The green finance market can be subject to fluctuations and uncertainties, affecting the availability and cost of Green Dollar Loans.

2. Regulatory Changes:

Changes in government policies and regulations may impact the eligibility criteria, terms, and availability of Green Dollar Loans.

3. Default Risks:

As with any lending, there’s a risk of default associated with Green Dollar Loans, particularly if borrowers fail to manage their projects or meet repayment obligations.

4. Project Viability:

Assessing the feasibility and viability of green projects can be challenging, leading to potential financial risks if projects do not deliver the expected results.

5. Lack Of Awareness:

Limited awareness and understanding of green financing options among borrowers and lenders can hinder the uptake of Green Dollar Loans.

Conclusion:

In conclusion, Green Dollar Loans offer a unique opportunity for individuals and businesses to address their financial needs while positively impacting the environment. By investing in green projects and initiatives, borrowers can contribute to a more sustainable future for future generations.

FAQs:

1. Are Green Dollar Loans Only Available To Homeowners?

Green Dollar Loans are available to individuals and businesses seeking to finance environmentally friendly projects.

2. What Types Of Projects Can Be Financed With Green Dollar Loans?

Green Dollar Loans can fund various projects, including energy-efficient upgrades, renewable energy installations, sustainable agriculture, and eco-friendly business initiatives.

3. Do Green Dollar Loans Require Collateral?

Collateral requirements may vary depending on the lender and the specific terms of the loan agreement. Some Green Dollar Loans may require collateral, while others may be unsecured.

4. Are Green Dollar Loans More Expensive Than Traditional Loans?

Interest rates and terms for Green Dollar Loans can vary depending on the lender’s and borrower’s creditworthiness. While some green loans may offer competitive rates, others may be slightly higher due to the specialized nature of the financing.

5. How Can I Find A Lender That Offers Green Dollar Loans?

Many banks, credit unions, and financial institutions offer Green Dollar Loans as part of their product offerings. It’s advisable to shop around and compare rates and terms from multiple lenders to find the best option.

Read: